The amount of money you can send through Zelle using your business account will vary depending on your bank. How much can you Zelle from a business account? Some banks, such as Amerant, charge customers a small fee of $2 for each incoming or outgoing transaction made through Zelle.⁶ US Bank is another provider that offers its customers fee-free payments through Zelle.⁵ Only the mobile carrier’s message and data rates could apply.³Īnother top provider of Zelle, Wells Fargo, offers the same conditions.⁴

Zelle transfer limit free#

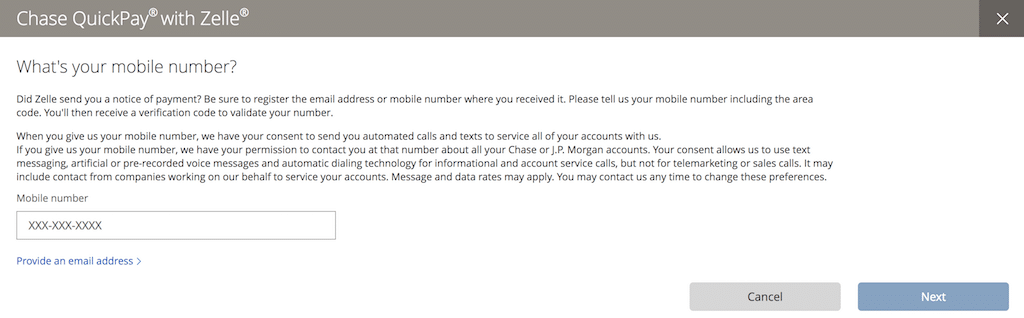

While some larger providers of Zelle offer free payments with the service, others don’t.Ĭhase Bank, offers its customers free payments through Zelle. The fee you pay for sending or receiving will largely come down to the bank you use. Unfortunately, it’s hard to say definitively how much it will cost for you to use Zelle since there is no universal fee. Does Zelle charge a fee for business accounts?

Not every bank that’s compatible with Zelle offers it for business accounts.Įnrolling with Zelle is completely free of charge, however, there are some fees associated with the various banks that offer it. ⚠️ Please note that these providers offer Zelle for small businesses.

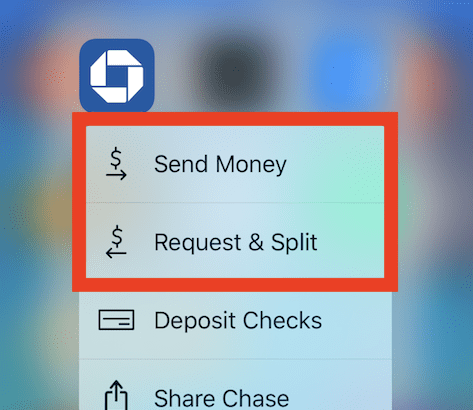

Here are some of the most well-known banks that feature Zelle integration for small businesses: Zelle now supports a huge number of banks as a result. The first time Zelle came to market with its current name was in 2017, and since then the payment platform has enjoyed a surge in popularity.

Zelle transfer limit code#

You can get local account details such as an account number and sort code in up to 10 currencies, which means you can pay and get paid like a local.įortunately, there are many banks that offer Zelle as a payment processing platform for their customers.īear in mind that these banks are all based in the US, since Zelle only permits US transactions made in US dollars.² 💡 With the Wise Business Account, you can create US account details for your business even if you’re not living in the country. If your bank is based outside the States you won’t be able to use your business account with Zelle. The other restriction is that Zelle is only available to US bank accounts. To make the most of Zelle with your business account, you’ll need to reach out to the bank bank or credit union to make sure they offer this as an option. There is a long list of banks compatible with the Zelle processing system, but there are still some who don’t support it.¹ While Zelle is available for some business accounts, it depends on the bank in question. If you’re wondering ‘Can I use Zelle with a business account?’, here’s what to expect: Receive international payments with Wise Is Zelle available for business accounts? Looking for an international business account? Try Wise.Who can a Zelle business account be a good choice for?.Is Zelle available for business accounts?.

Let’s see if a Zelle business account could be useful for you. Many businesses have taken to the platform to keep the ball rolling with real-time online payments. If you’re a US-based business owner, you can connect Zelle to compatible business bank accounts to simplify the payment process. The payment platform integrates with several banking apps, and also has its own app. Zelle is a payment processor that allows you to make peer-to-peer payments.

0 kommentar(er)

0 kommentar(er)